OVERVIEW

Fitzwilliam Group are specialist property developers with many years’ experience creating highly successful property schemes across the UK. We design modern, stylish and lucrative homes and investment opportunities in key UK locations. Our focus is on providing well thought out, market competitive opportunities for our clients and customers.

Fitzwilliam Capital Partners also specialise in Planning Gain opportunities, sourcing financially viable projects and potentially selling them on (often direct to our contacts) for a profit.

A Case Study of a previous successful planning gain project by the Fitzwilliam team can be found by clicking this link:

https://www.leopropcrowd.com/property/detail/case-study-meadowhall-fitzwilliam-group

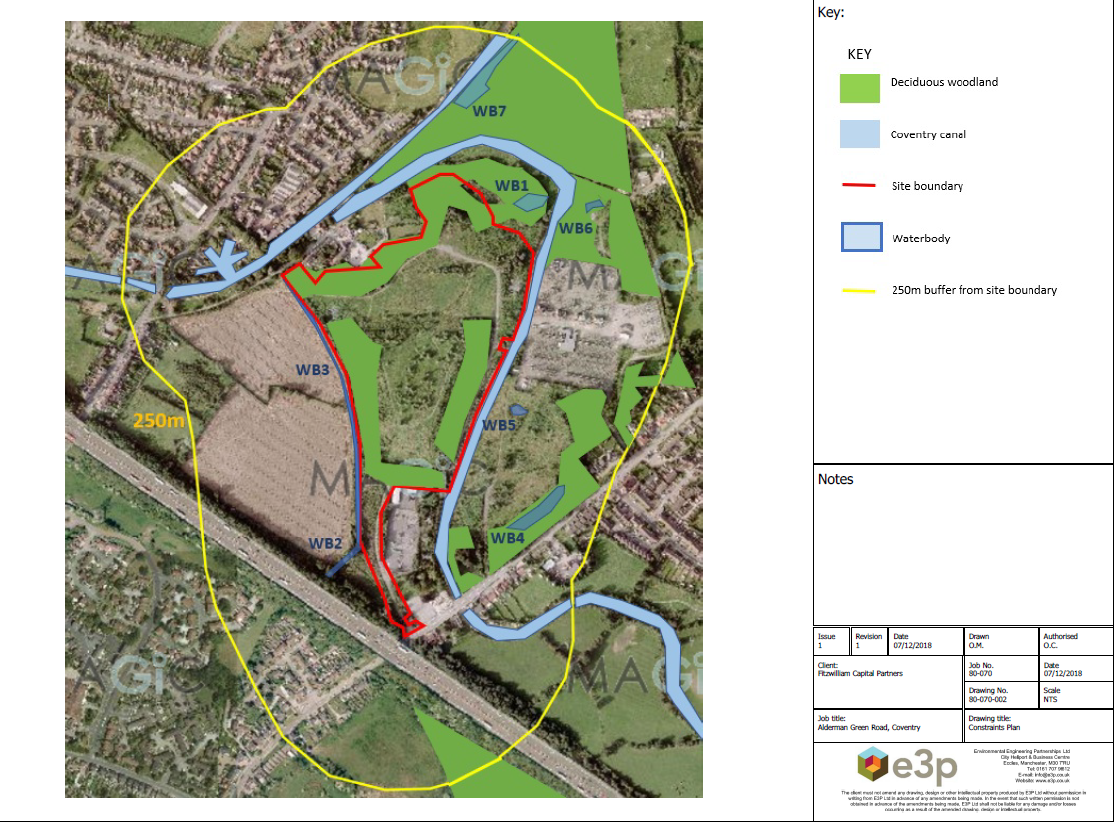

ALDERMAN'S GREEN PROJECT

This project aims to gain planning permission for the site and then sell the development opportunity for a profit. The project involves acquiring this plot of land on a single freehold basis, with the aim of achieving outline planning permission for c.380 homes with a land mass of 85% based on the site which covers 30 acres.

The site has previously benefited from planning for a mixed use scheme (full details in the Equity Offer Document Attached), but this has lapsed.

This site is legally secured with a conditional contract, subject to planning. The funds raised will pay for the planning application and associated expenses.

The exit for investors will occur at the time of a subsequent sale of the land with planning or from securing finance and drawing down that finance, if the company chooses to build out the site.

Case Studies for similar planning gain projects successfully completed by this team can be found in the attached Equity Offer Document.

NOTE- While the project is in VIEW DEAL, the offer material may be amended before the offer goes live.

FINANCIALS

Raise Amount: £120,000 (Minimum £50,000)*

Minimum Investment: £100

Return on Investment: 45%

Project Length: 9-12 Months

Offer Live for Investment: 11th October 2019

Closing Date for Investment: 14th November 2019

The site is legally secured with a conditional contract, subject to planning. The funds raised will pay for the planning application and associated expenses.

Fitzwilliam Capital Partners (Coventry) Limited, is offering preference shares with the following key details:

The plan is to exit after planning has been fully obtained and signed off. For the purpose of this offer, the company estimates the value of the site with planning will be approximately £9,000,000. To reach the point where planning is in place, the costs are estimated to be £4,000,000. Included in this cost estimate is the purchase of the site.

£120,000 is the maximum target raise to fund the planning work. The projected return to the investors funding the raise is 45% (return on investment; not annualised).

If the site is sold without planning or it is sold with planning, the crowd investors will be first in line to receive a return on their investment assuming profit is realised. Fitzwilliam Capital Partners (Coventry) Limited will only receive a share of the profit after the crowd investors have received a minimum targeted return of 45%. Once the crowd investors have received the minimum targeted return, any profits in excess of what was needed to pay out the crowd investors will be distributed on a fully diluted basis and proportional to the cumulative share holdings of all common shareholders and crowd preference shareholders.

The preference shares have no voting rights.

The preference shares have no voting rights.

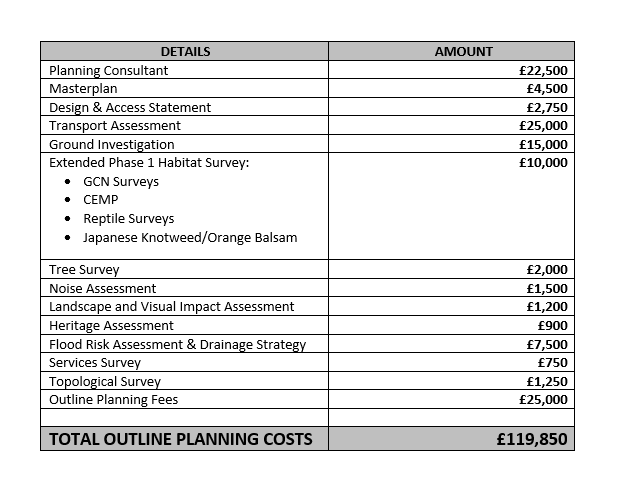

OUTLINE PLANNING COSTS BREAKDOWN

See Offer Document for more details of the £119, 850 Outline Planning Costs.

* Note: If the minimum raise of £50,000 is reached, the developer will cover any difference between the minimum and maximum raise amount as required.

While the project is in VIEW DEAL, the offer material may be amended before the offer goes live.

DAIREANN GIBSON

Director of Legal and Compliance

In addition to his role as Director of Legal & Compliance at the Fitzwilliam Capital Partners Group, Daireann is also the Managing Partner of Gibson & Associates Solicitors having previously worked with top-tier firms in Northern Ireland, Republic of Ireland and New York.

He has a keen interest and extensive multi-jurisdictional experience in residential and commercial property development, financing, acquisitions and disposals, together with advising on a wide range of corporate and property related matters.

He has a keen interest and extensive multi-jurisdictional experience in residential and commercial property development, financing, acquisitions and disposals, together with advising on a wide range of corporate and property related matters.

RUSSELL PRICE

Fund and Acquisition Director

Russell has worked within the property industry for over 20 years and is one of the founding members of the Fitzwilliam Capital Partners Group. He is the Group Fund and Acquisitions Director and is responsible for the Groups strategic acquisitions and disposals.

CAROLINE SMITH

Legal Services

Caroline is a qualified solicitor admitted to practice in England & Wales and has spent her career dealing with a broad range of residential and commercial property work. She specialises in sales and purchases of both freehold and leasehold titles within multi-unit developments, with a strong reputation for closing deals effectively and on time.

GLENN FULTON

Quantity Surveyor

Glenn is a qualified Quantity Surveyor with 25 years’ experience in the construction, development and property industries. He has spent his career working at a senior level within the residential and development sector, leading and negotiating high value projects to secure company growth.

PHIL MULRONEY

Chartered Surveyor

Phil qualified with a BEng in Civil Engineering from the University of Sunderland, before becoming a Chartered Surveyor. Prior to joining the Fitzwilliam Group, Phil has held senior positions managing, acquiring, building and disposing of properties throughout the UK and Europe over his 25 year career.