OVERVIEW: Planning Uplift Project

Greetings from CurationTech99! We are delighted to announce that in partnership with our property crowdfunding partners LEOcrowdfunding, we are launching our Barn Hill View Estate Limited Planning Uplift project.CurationTech99 is mainly focused on residential developments, and targets new build houses/apartments and serviced apartment businesses in tourist areas. Hand-in-hand with this is the achieving of planning permission to proceed with these developments. This is the first planning uplift project that CurationTech99 have brought to the LEOcrowdfunding platform

Executive Summary

This latest project is a planning uplift for a project in Powmill, Kinross, Scotland for potentially nine houses. We have exchanged on the land subject to planning with a non refundable deposit from our end and have appointed an architect for the planning process. The aim of this site is to purchase a brownfield site at Barnhill Farm and we intend to get planning for up to nine dwellings within the next six months and have senior debt finalised if required thereafter for the build phase.There have been previous planning applications on the site, some of which have been successful but have not been actioned. A similar application on another part of the access road has been granted permission and this is currently being built out.

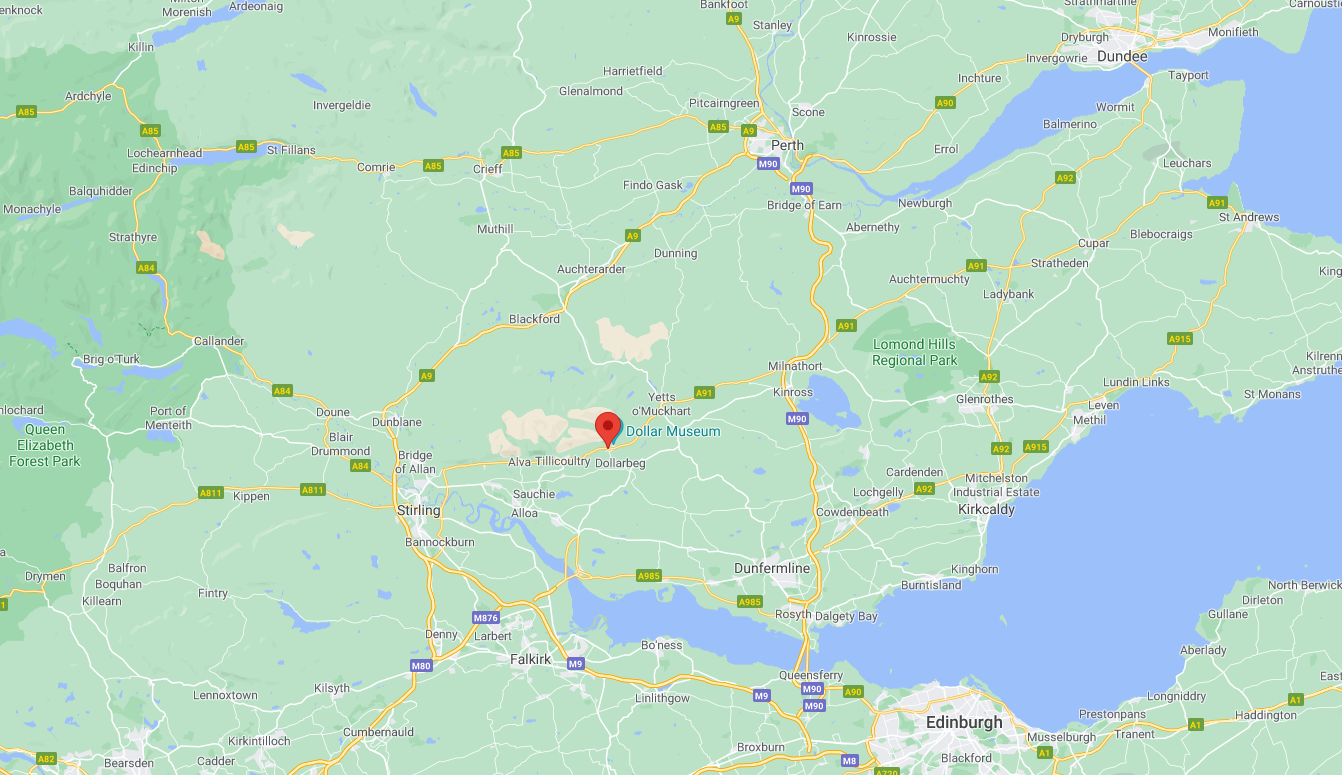

Location

The land totals 35 acres (14.16 hectares) and is exceptionally well situated for the tourist market and also for those who are seeking homes with additional land that would accommodate horses or perhaps a small homestead. Powmill is a village lying just north of Edinburgh, and within easy reach of Dunfermline and Stirling (with its historic castle). Additionally, the lovely shores of Loch Leven are located to the east. It is near the main road between Dollar and Stirling to the west and St Andrews on the shore of the Loch.

Project Details

The site consists of former farm buildings, now demolished which had previously been used by a charity, which sadly had to be wound up due to the current pandemic. They form part of the whole farm buildings complex. We are confident that the planners will look favourably on the application, as we have really focussed on creating a development which will be both attractive to potential purchasers and is in accordance with local planning policy. The properties will be built on the existing footprint of the current (now mostly demolished) buildings. On the granting of planning permission, we will seek to market the development opportunity and the uplift will be distributed

The Opportunity

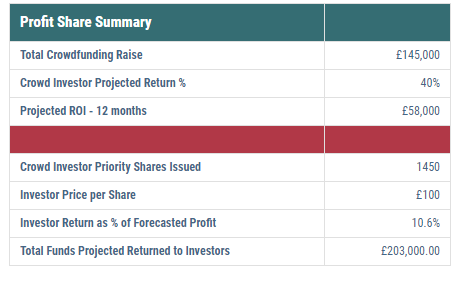

Crowd Investors receive a projected 40% Return on Investment (ROI) by way of priority shares. Priority share means that the crowd investors will receive their profit share before the fundraiser receives theirs. 40% ROI on £145,000 equals £58,000, representing 10.6 % on the projected profits, estimated to be £545,000, based on the value of the land with planning permission.

Investment in property related assets puts your capital at risk and returns are not guaranteed. Please read the full risk warning on this site before deciding to invest.

FINANCIALS

Crowd Investors receive a projected 40% Return on Investment (ROI) by way of priority shares. Priority share means that the crowd investors will receive their profit share before the fundraiser receives theirs.

40% ROI on £145,000 equals £58,000, representing 10.6% on the projected profits, estimated to be £545,000 based on the value of the land with planning permission.

The £145,000 equity raise will form a pot of funds from which, the fees associated with applying for the planning permission are drawn. The maximum raise has been set at £145,000, with a minimum at £100,000.

Investment in property related assets puts your capital at risk and returns are not guaranteed. Please read the full risk warning on this site before deciding to invest.

HIETESH SHRIDHAR

Chief of Operations & Projects

Hietesh has 14 years of experience in engineering consulting, project & cost management, and on-site construction. He has worked with the Indian construction industry for most of his career and has commissioned multiple projects ranging from warehousing, industrial, commercial, hospitality, medi-care, residential, data centres, network operating centres and mixed land use projects.

Sector Expertise: Hietesh has acquired key experience in commissioning warehouses, warehouse automation, industrial, hotels, data centres, video walls and mixed land use projects.

RAYAN SINGH

Chief of Real Estate and Sales

Resourceful, flexible, innovative, and professional project manager with considerable knowledge of the construction industry. Possessing excellent organisational, planning and time management skills, as well as boasting a consistent track record of improving efficiency, maximising profits whilst minimising costs. A confident and reliable individual with a commercial approach to solving problems. Able to manage and co-ordinate all construction activities and ensure that all project deliverables are achieved with regards to safety, quality, programme, and cost.

RAJEEV K BANSAL

Chief of Finance and Acquisitions

Rajeev has 30 years of experience as a developer and in project management. He has worked with the Indian development and construction industry for most of his career and has commissioned multiple projects ranging from industrial, commercial, hospitality, medi-care, residential, data centres, network operating centres and mixed land use projects.