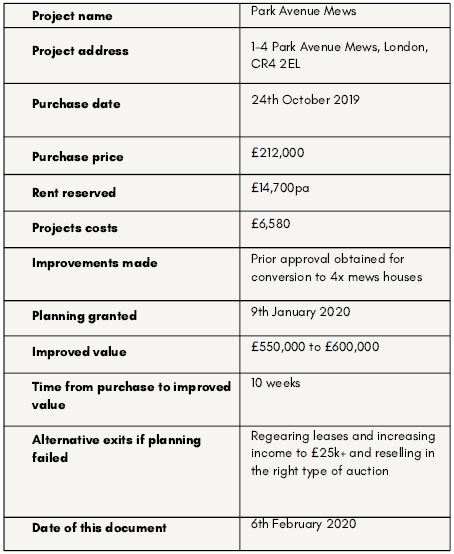

OVERVIEW - Case Study by YOUR PROPERTY AUCTIONS

Please note that all the information provided below and in the following tabs have been supplied by Your Property Auctions and that these have not been verified by LEOpropcrowd.

Your Property Auctions is run by Jay Howard and Piotr Rusinek, property professionals based in London. Both have strong property sourcing and investment background. Their model is to purchase property at auction below market value and either resell or add value and then resell.

Jay and Piotr are the authors of the Amazon No. 1 Best Seller

‘Before The Hammer Falls: The Insider's Guide to Property Auction Success’.

With their experience in the auction field, their network of professional contacts and their access to opportunities, they are uniquely placed in the marketplace, to be able to identify and execute opportunities at auction.

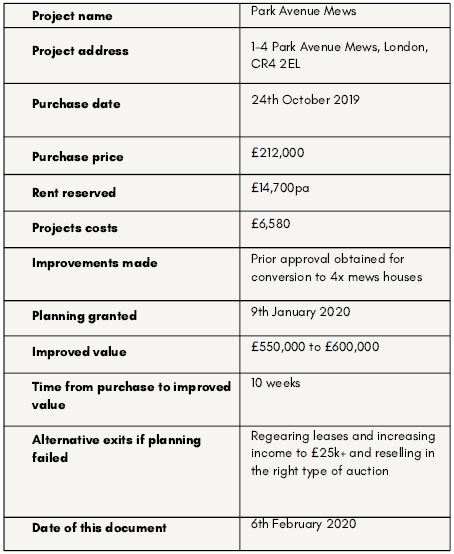

PARK AVENUE MEWS - TOOTING, LONDON

Our secondary exit, if the permitted development was refused, would have been to re-gear the commercial leases, aiming to secure FRI Leases for each of the units for 5-7 year terms, at a market rent producing approx. £25,000 per annum. Based on this projected figure the workshops should sell in excess of £300,000 in a more suitable auction (with only paperwork value added), whilst generating a healthy 7% yield in the meantime.

We considered this the worst-case scenario for the project.

Please note that all the information provided below and in the following tabs have been supplied by Your Property Auctions and that these have not been verified by LEOpropcrowd.

Your Property Auctions is run by Jay Howard and Piotr Rusinek, property professionals based in London. Both have strong property sourcing and investment background. Their model is to purchase property at auction below market value and either resell or add value and then resell.

Jay and Piotr are the authors of the Amazon No. 1 Best Seller

‘Before The Hammer Falls: The Insider's Guide to Property Auction Success’.

With their experience in the auction field, their network of professional contacts and their access to opportunities, they are uniquely placed in the marketplace, to be able to identify and execute opportunities at auction.

PARK AVENUE MEWS - TOOTING, LONDON

Freehold row of 4 commercial workshops in a predominantly residential area, purchased at auction with a view to adding significant value.

We purchased the Tooting deal at the September 2019 Harman Healy auction for £212,000 and after some expected competitive bidding, secured the asset with an income of £14,700, which represents a healthy London 6.93% yield.

Our primary exit strategy was to obtain permitted development for change of use from workshop to residential conversion to provide 3-4 houses. If successful we would either sell with the permitted development back into auction or apply for stage 2 planning and again, either sell at this stage or proceed with the development.

We received notification of our grant for prior approval on the 9-1-2020 for creating 4 x mews houses.

Based on local sales and £ per square feet, we have projected a GDV of £1.175M in the current configuration.

Our primary exit strategy was to obtain permitted development for change of use from workshop to residential conversion to provide 3-4 houses. If successful we would either sell with the permitted development back into auction or apply for stage 2 planning and again, either sell at this stage or proceed with the development.

We received notification of our grant for prior approval on the 9-1-2020 for creating 4 x mews houses.

Based on local sales and £ per square feet, we have projected a GDV of £1.175M in the current configuration.

Our secondary exit, if the permitted development was refused, would have been to re-gear the commercial leases, aiming to secure FRI Leases for each of the units for 5-7 year terms, at a market rent producing approx. £25,000 per annum. Based on this projected figure the workshops should sell in excess of £300,000 in a more suitable auction (with only paperwork value added), whilst generating a healthy 7% yield in the meantime.

We considered this the worst-case scenario for the project.

FINANCIALS

All of our auction purchases are bought with multiple exit strategies planned in advance. This is the de-risking, risk mitigation and risk management approach we always take in order to create successful and profitable transactions at auction.

Purchase price: £ 212,000

Legals: £ 1,800

Legals for serving notices: £ 1,440

Stamp Duty Land Tax: £ 1,240

Planning consultant fee: £ 1,200

Measured surveys: £ 800

Prior approval app fee: £ 100

Total costs: £ 218,580

VALUES

3 x 1 bedroom mews houses (approx 40sqm each) -£275,000 x 3 = £825,000

1 x 2 bedroom mews house (approx 50sqm) - £350,000 x 1 = £350,000

Total GDV £1,175,000

Estimated costs of conversion: £275,000

Total costs including purchase: expected below £500,000

PROFITS

1. Expected profit if built out: £675,000

2. Expected profit if sold now with planning: £350,000 to £400,000

Legals: £ 1,800

Legals for serving notices: £ 1,440

Stamp Duty Land Tax: £ 1,240

Planning consultant fee: £ 1,200

Measured surveys: £ 800

Prior approval app fee: £ 100

Total costs: £ 218,580

VALUES

3 x 1 bedroom mews houses (approx 40sqm each) -£275,000 x 3 = £825,000

1 x 2 bedroom mews house (approx 50sqm) - £350,000 x 1 = £350,000

Total GDV £1,175,000

Estimated costs of conversion: £275,000

Total costs including purchase: expected below £500,000

PROFITS

1. Expected profit if built out: £675,000

2. Expected profit if sold now with planning: £350,000 to £400,000

All of our auction purchases are bought with multiple exit strategies planned in advance. This is the de-risking, risk mitigation and risk management approach we always take in order to create successful and profitable transactions at auction.

Jay Howard

Director

Jay been active within the property industry for the past 18 years, starting his professional career with a high street estate agency, then moving to asset management, property development, trust fund and asset management and finally auctions.

Higher Education

Psychology | 1998 | Kings College

Classics | 2005 | Queens College

Law | 2009 | West London University

Author of the Amazon No. 1 Best Seller

‘Before The Hammer Falls: The Insider's Guide to Property Auction Success’

Higher Education

Psychology | 1998 | Kings College

Classics | 2005 | Queens College

Law | 2009 | West London University

Author of the Amazon No. 1 Best Seller

‘Before The Hammer Falls: The Insider's Guide to Property Auction Success’

Piotr Rusinek

Director

Piotr has been a London based property investor specializing in the property auctions market for the past 8 years, establishing himself as a knowledgeable and trustworthy partner to his clients. In this time Piotr has brought and sold over £20,000,000 worth of real property assets for himself and his clients.

Higher Education

Economics & Finance | 2010 | Aberdeen University

Author of the Amazon No. 1 Best Seller

‘Before The Hammer Falls: The Insider's Guide to Property Auction Success’

Higher Education

Economics & Finance | 2010 | Aberdeen University

Author of the Amazon No. 1 Best Seller

‘Before The Hammer Falls: The Insider's Guide to Property Auction Success’