OVERVIEW - Case Study by TAYLOR CAPITAL

Please note that all the information provided below, in the following tabs and in the downloadable documents have been supplied by Taylor Capital and that these have not been independently verified by LEOpropcrowd.

Working with existing property investors and SSAS trustees, Taylor Capital helps you accelerate your income, grow your wealth and reclaim your time. This allows you to live life on your terms and escape your rat race, to do the things you always wanted to do.

In completing 36 property transactions over 25 years, Taylor Capital’s founder Dan Taylor has not only amassed a multi-million pound commercial portfolio but added significant value by combining creative commercial property strategies and business buying strategies.

Strike Project – Largs, Scotland

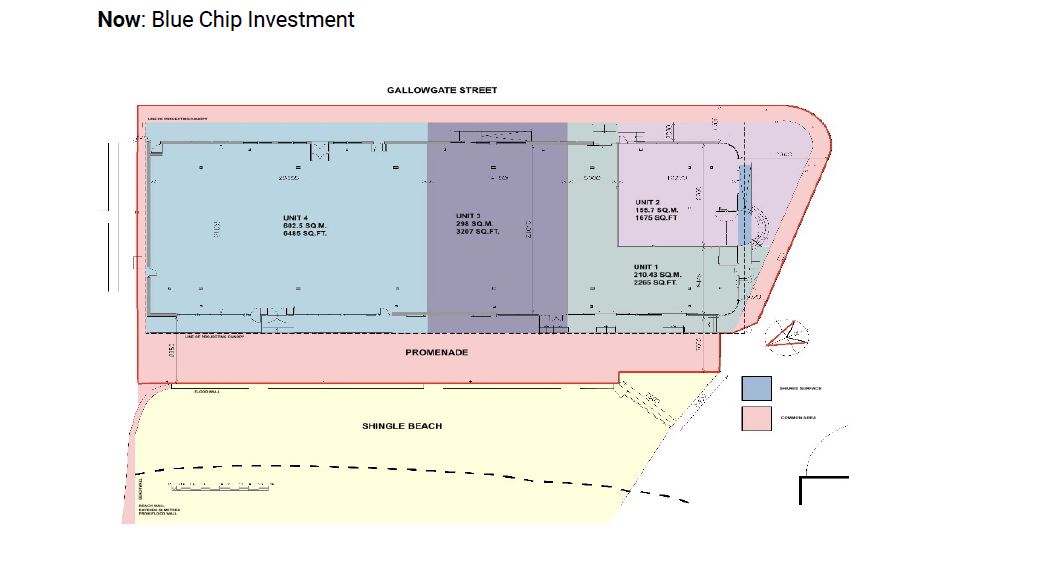

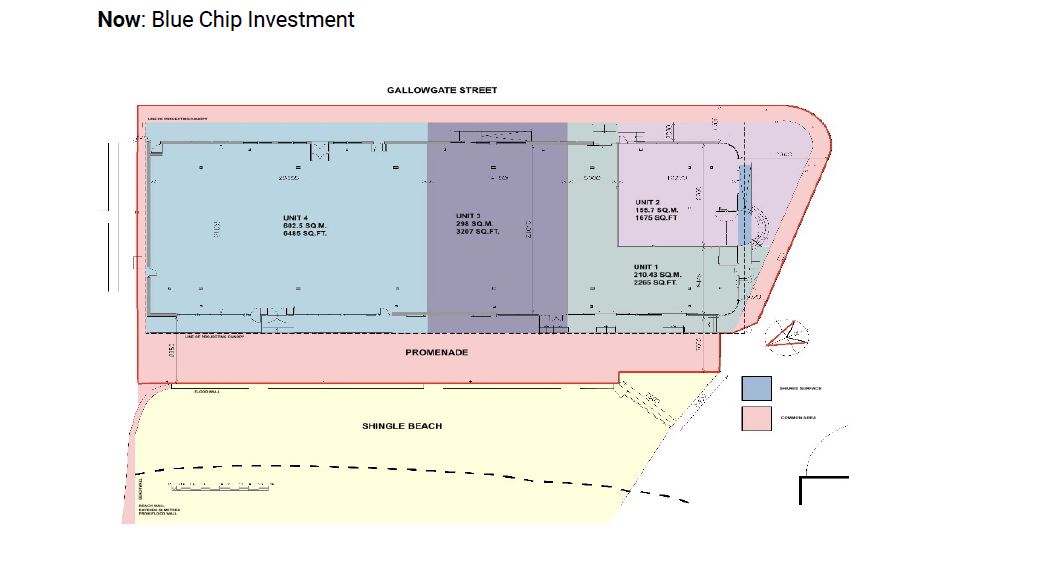

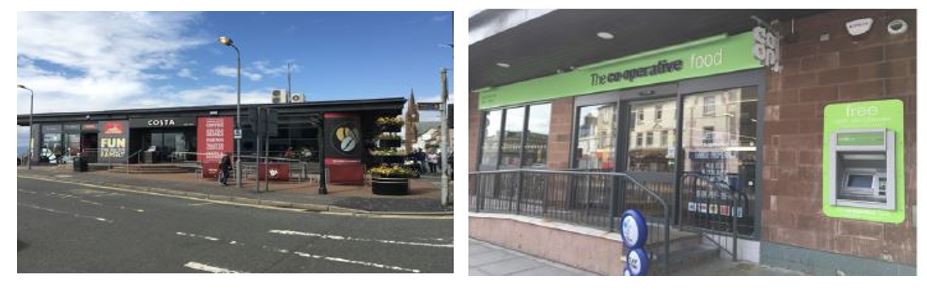

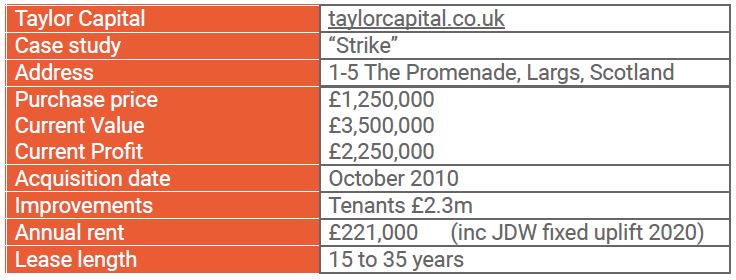

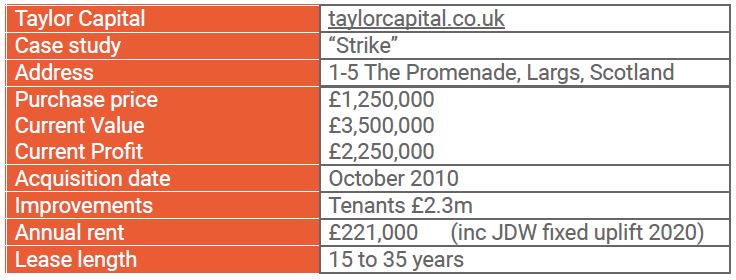

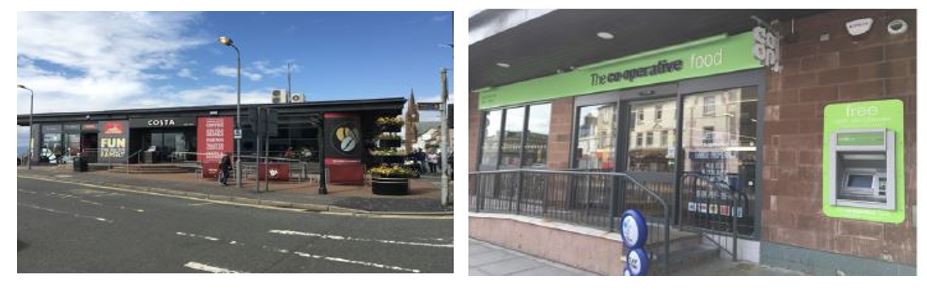

Strike was acquired in October 2010, a struggling bowling alley purchased for £1,250,000, situated on The Promenade in Largs, Scotland, with clear potential to be a profitable attraction in the local area. The project aim was to transform Strike into a highly profitable mixed-use space to be occupied by some of the nation’s favourite high street brands.

We managed to force capital appreciation from £1.25M to £3.5M.

Highlights

● Purchased: £1,250,000

● Current Value: £3,500,000

● Profit: £2,250,000

● Rental Income: £221,000

Local Regeneration

Taylor Capital not only seeks to generate income for investors, but our strategies focus on the reciprocal effects of regeneration and re-profiling of the town centre and the positive effects on local communities. Strike not only surpassed investment targets but boosted the local economy providing an extra 100 jobs, local suppliers increased business and the building’s turnover rocketed up from £400,000 to £7,200,000 amongst the local businesses occupying the space.

Please note that all the information provided below, in the following tabs and in the downloadable documents have been supplied by Taylor Capital and that these have not been independently verified by LEOpropcrowd.

Working with existing property investors and SSAS trustees, Taylor Capital helps you accelerate your income, grow your wealth and reclaim your time. This allows you to live life on your terms and escape your rat race, to do the things you always wanted to do.

In completing 36 property transactions over 25 years, Taylor Capital’s founder Dan Taylor has not only amassed a multi-million pound commercial portfolio but added significant value by combining creative commercial property strategies and business buying strategies.

Strike Project – Largs, Scotland

Strike was acquired in October 2010, a struggling bowling alley purchased for £1,250,000, situated on The Promenade in Largs, Scotland, with clear potential to be a profitable attraction in the local area. The project aim was to transform Strike into a highly profitable mixed-use space to be occupied by some of the nation’s favourite high street brands.

We managed to force capital appreciation from £1.25M to £3.5M.

Highlights

● Purchased: £1,250,000

● Current Value: £3,500,000

● Profit: £2,250,000

● Rental Income: £221,000

Local Regeneration

Taylor Capital not only seeks to generate income for investors, but our strategies focus on the reciprocal effects of regeneration and re-profiling of the town centre and the positive effects on local communities. Strike not only surpassed investment targets but boosted the local economy providing an extra 100 jobs, local suppliers increased business and the building’s turnover rocketed up from £400,000 to £7,200,000 amongst the local businesses occupying the space.

FINANCIALS

NB: Past performance is not a reliable indicator of future results.

Taylor Capital applied trusted strategies to upgrade the asset and added considerable value, generating £2.25 million in profit and inserting multiple national high street brands as tenants on lease terms of 15 - 35 years. This created a long-term collective annual income of £221,000, inflation-protected increasing every 5 years. The five high profile national operators are as follows:

The increase in value and high-quality lease arrangements with long-term national brands, hugely reduces risk and creates a lowly geared investment that will survive and thrive during the next economic correction.

NB: Past performance is not a reliable indicator of future results.

Taylor Capital applied trusted strategies to upgrade the asset and added considerable value, generating £2.25 million in profit and inserting multiple national high street brands as tenants on lease terms of 15 - 35 years. This created a long-term collective annual income of £221,000, inflation-protected increasing every 5 years. The five high profile national operators are as follows:

Dan Taylor

Founder

Dan has completed over 36 transactions with a value in the tens of millions, though more importantly, he has added significant value by combining creative commercial property strategies and business buying strategies. Dan is most proud of helping his clients to collapse time and create life-changing results while simultaneously de-risking the project.

Dan has been doing this for around 25 years and after successfully adding an extra, multiple eight figure sum to the value of a commercial property portfolio that he already owned through simple paperwork, he subsequently contracted with a PLC to sell the business and retain the commercial property portfolio to create passive long-term income.

Now Dan helps SSAS trustees and existing residential property investors simplify everything, create income and grow their wealth via commercial property without the hassle of residential or risk of refurbs.

Dan has been doing this for around 25 years and after successfully adding an extra, multiple eight figure sum to the value of a commercial property portfolio that he already owned through simple paperwork, he subsequently contracted with a PLC to sell the business and retain the commercial property portfolio to create passive long-term income.

Now Dan helps SSAS trustees and existing residential property investors simplify everything, create income and grow their wealth via commercial property without the hassle of residential or risk of refurbs.