OVERVIEW: CASE STUDY - Planning Uplift Project

Please note that all the information provided below and in the following tabs has been supplied by Space+ and it has not been verified by LEOcrowdfunding.

Executive Summary

SPACE+ was formed in 2013 in Cambridge by husband and wife team - Dirk & Adri Visagie. We both hold degrees in Architecture from South Africa, and bring 30 years combined UK experience. We specialise in Design and Project Delivery for property Development, with a focus on Planning Uplift Opportunities.

The use of Building Information Modelling (BIM) software is central to how we deliver projects from initial feasibility stage through to planning, technical delivery and use. As SPACE+ we are focussing on Planning Uplift Opportunities, UK wide. We are identifying sites like the one in the case study below or we will partner with others who already have sites.

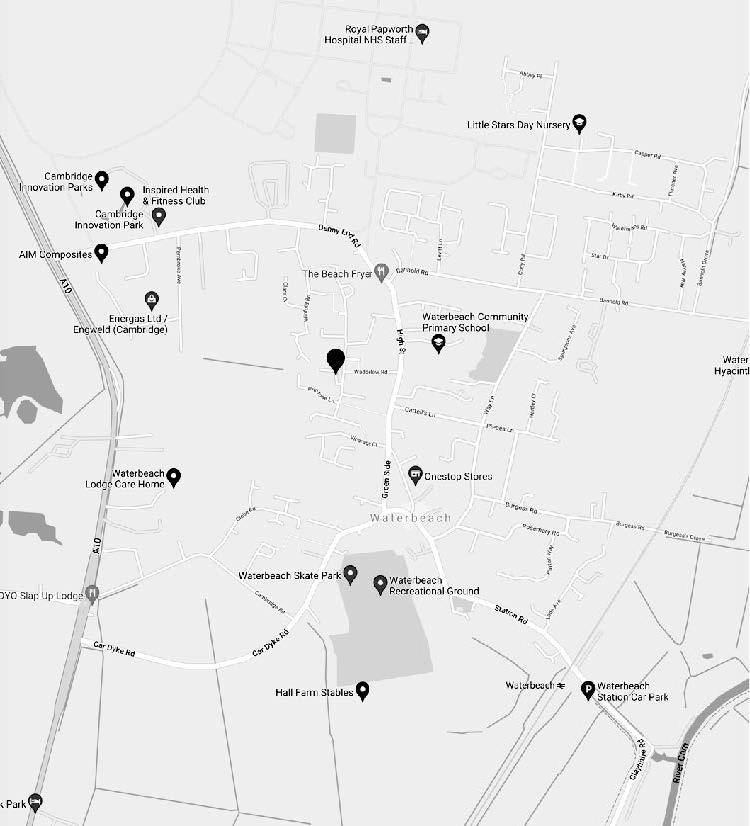

The Project: Location

The site is in Waterbeach, a popular village on the banks of the River Cam just 6 miles north of Cambridge.

The property is located close to the village high street with its excellent facilities and attractive village green, with a range of local shops, pubs and restaurants. There is road access from the site to Cambridge via the A10 main road. Added to this there is a good bus service available and a nearby railway station providing direct links to Cambridge and London, the latter of which can be reached in around an hour. There is also convenient access to Cambridge Science Park and Milton Country Park.

The Project: Details

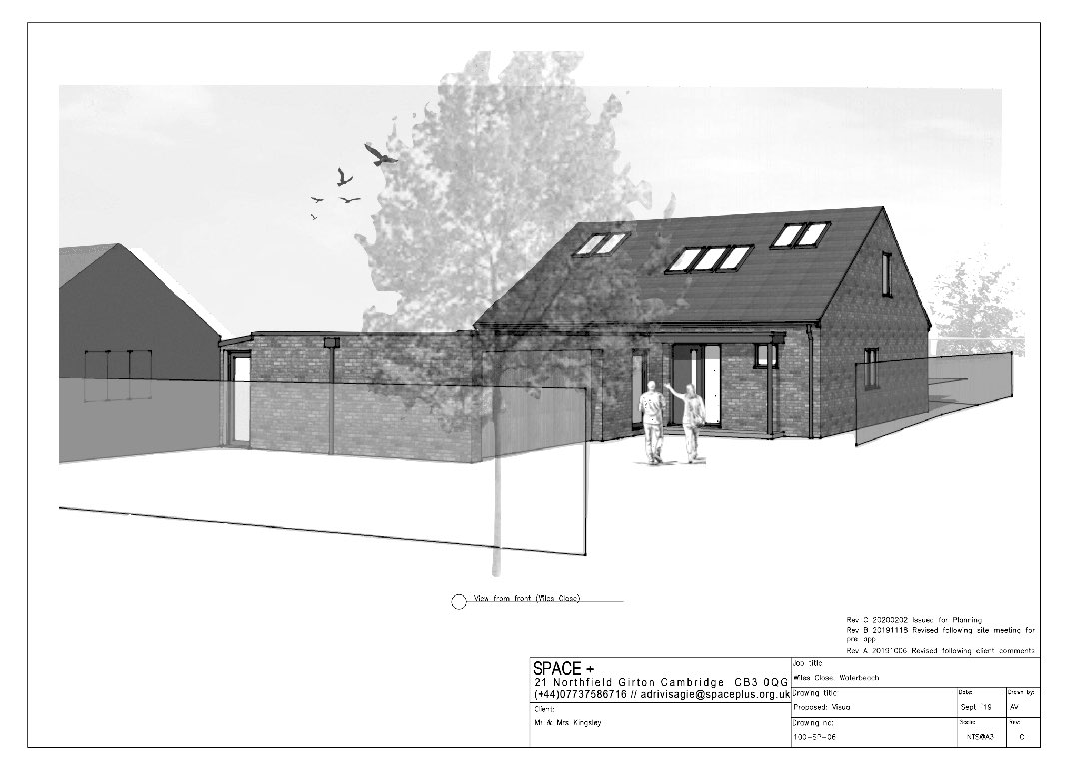

The site was attractive due to its location close to Cambridge and the site already had outline planning permission - we realised further value could be added by increasing the size of dwelling on the site. The site had been previously purchased by KH Construction (our partners in this venture) and the empty site already had outline planning consent for a 2 bed bungalow already in place.

SPACE+ obtained further planning consent for a larger 3 bed dwelling over 2 floors including a 2 car garage to increase the overall size of the dwelling and thus achieving planning uplift.

Early engagement with Local Council to create a bespoke modern family dwelling that can be adapted in the future for M4(3) lifetime home standard for accessibility.

The total timescale for the project was 8 months: the first 3 months concentrated on the purchase of the property and the pre-application submission and feedback; the second 5 month period focussed on submitting of the full planning application and the gaining of approval.

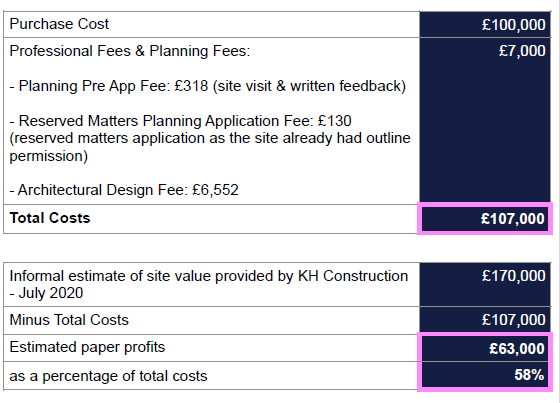

FINANCIALS

Wiles Close, Cambridge

• SPACE+ was contracted to obtain planning permission for a larger dwelling and our role ended when we achieved planning in June 2020

• KH Construction, long term builder in the area decided to go forward based on their own internal way of estimating - informal estimate of site value provided by KH Construction - Jul 2020

• At the time of this case study KH Construction is progressing with the build with estimated completion in Nov 2021.

Dirk Visagie

Space+ Founder

• Dirk Visagie qualified as an Architect in South Africa in 2006

• UK experience since 2006 in delivering projects in architectural design and project management

• Established SPACE+ Design in 2013, alongside his wife Adri; Ltd status from 2019

• Completed multiple projects to date with KH Construction

• Areas of expertise include: Feasibilities, Planning, New Build, Refurbishments, Conversions,

Change of Use, Conservation & Heritage and Sustainability

Adri Visagie

Space+ Founder

• Adri Visagie qualified as an Architect in South Africa in 2006

• UK experience since 2006 in delivering projects in architectural design and project management

• Established SPACE+ Design in 2013, alongside her husband, Dirk; Ltd status from 2019

• Completed multiple projects to date with KH Construction

• Areas of expertise include: Feasibilities, Planning, New Build, Refurbishments, Conversions,

Change of Use, Conservation & Heritage and Sustainability

Ian Kingsley

Owner, KH Construction

Ian Kingsley is the owner of KH Construction in Cambridge

• Over 20 years experience as a building contractor and developer in Cambridge and surrounding areas

• Team of directly employed tradespeople including ground workers, carpenters, bricklayers, plant operators, electrical, mechanical and maintenance services

• High standards of workmanship and communication