Overview

Project: Citygate House, Leicester

Executive Summary

Citygate House, Leicester, located on St Margaret’s Street, Leicester, LE1 3DA, is brought to you by Student Vault Management Ltd. The fundraiser wishes to raise a maximum of £600,000 (the minimum target is £400,000) and are offering a return on investment of 20% per annum (based on net profits after corporation tax). The minimum investment amount is £1000 and the timeline for the project is approximately 18 months with an expected completion date of December 2022.

Project Details

The proposal seeks to convert an existing building (Citygate House) from a commercial office premises into a high quality residential scheme of 56 units. The project will comprise a mix of one bed and studio apartments. and the redevelopment will be done under Permitted Development Rights. The purchase of the property was completed in April using a £500,000 vendor loan and £100,000 from the fundraiser. This raise is to replace this £600,000 of funds.

The current existing building is of some significance to the city of Leicester. The plan is to convert, extend and remodel the existing property into a modern, complex of rental apartments, incorporating an inner courtyard and roof garden. This will be carried out under Permitted Development rights. The main objective of the project is to deliver suitable accommodation for the current times. The building was previously home to a variety of different class B1 businesses before being bought by Student Vault Management Ltd. The current building comprises 18,000sq ft over three floors and it is the redevelopment of this building that will comprise the project.

Location

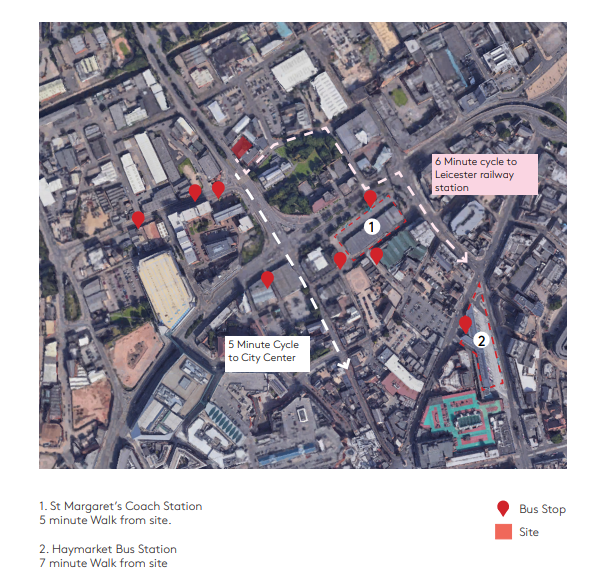

The site resides within the Waterside regeneration area, one of the most exciting large-scale regeneration opportunities in the East Midlands. The Citygate House scheme optimises the aspirations for the wider regeneration project, which is to create a thriving neighbourhood with great places to live. The development will improve accessibility to jobs, homes and services, as well as connecting areas such as the riverside and water corridors through sustainable transport.

The site is centrally situated in Leicester's city centre being 300 yards from Leicester's Main Bus Depot and a five minute walk to High Cross Shopping Centre. It is also 20 minutes from Leicester railway station.

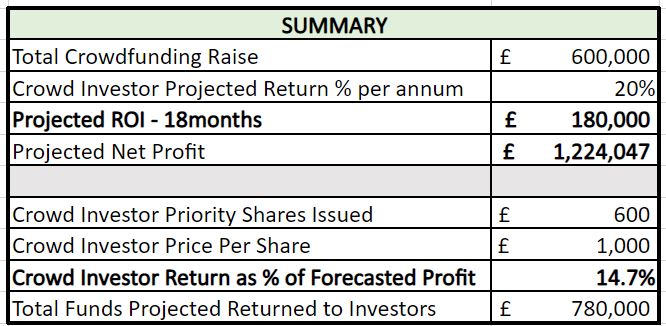

Investment and Exit

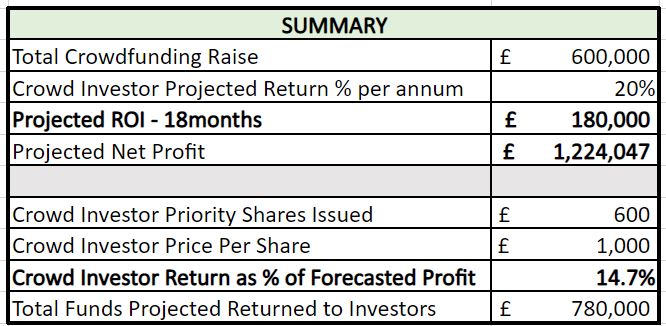

Crowd investors receive a projected 20% per annum Return on Investment (ROI) by way of a priority share. Priority share means that the crowd investors will receive their profit share before the fundraiser receives theirs. 20% per annum for 18 months on the £600,000 equity investment is £180,000 and this figure is 14.7% of the projected profits, which are estimated to be £1,224,047.The project offers investors potentially three different exit options:

EXIT OPTION 1

The favoured exit is by way of a sale to a fund. This exit has been achieved by the fundraiser on multiple other projects. The projected ROI due to investors will come from the sale of the whole building. There is the possibility of achieving a forward purchase by a fund that would reduce the risk of the project but that may reduce profits.

EXIT OPTION 2

If the sale of the building is not achieved to a fund then the units will be sold individually. Sales can be off-plan or marketed after completion.

EXIT OPTION 3

If the units are not sold to a fund or on the open market then they will be rented and the units refinanced at an expected 75% LTV. Any shortfall in the refinance amount and the funds due to investors will be met by the fundraiser from other sources and assets.

Investment in property related assets puts your capital at risk and returns are not guaranteed. Please read the full risk warning found on this platform before deciding to invest.

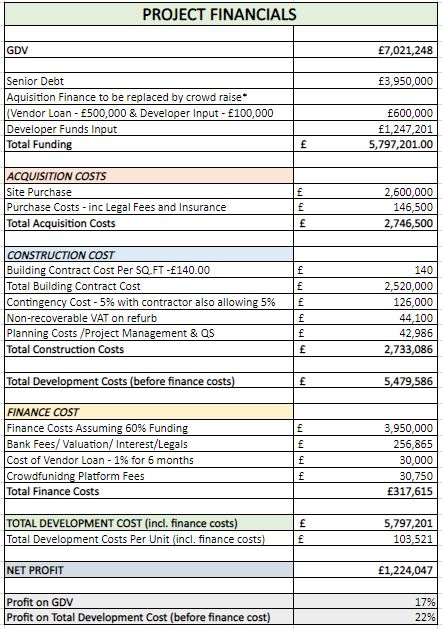

Financials

Crowd investors receive a projected 20% per annum Return on Investment (ROI) by way of a priority share. Priority share means that the crowd investors will receive their profit share before the fundraiser receives theirs. 20% per annum for 18 months on the £600,000 equity investment is £180,000 and this figure is 14.7% of the projected profits, which are estimated to be £1,224,047.

The £600,000 equity raise will go into the pot of funds being used to cover development costs. The maximum raise amount is £600,000 but the minimum has been set at £400,000. Once the minimum raise of £400,000 has been reached, these funds can be drawn down and used for the project.

Investment in property related assets puts your capital at risk and returns are not guaranteed. Please read the full risk warning found on this platform before deciding to invest.

£480,000 has been spent by the developer to date on this project, and a breakdown provided. The additional funds required will come from a refinancing of existing property assets, details of which have been provided to LEOcrowdfunding. Please note: LEOcrowdfunding has not undertaken any due diligence regarding how achievable refinancing of the fundraiser's existing property portfolio will be and has not been provided with an independent valuation of the fundraiser's existing property portfolio.

Investment in property related assets puts your capital at risk and returns are not guaranteed. Please read the full risk warning found on this platform before deciding to invest.

Vijay Patel

CEO of Student Vault Management Ltd

Vijay Patel, CEO of the Student Vault Management Ltd is a prolific and phenomenally successful property developer with over 10 years experience. Vijay's expertise lies in developing both PRS and PBSA schemes, having developed 27 schemes in total.

Vijay is relentless in his pursuit of developing schemes across the UK that offer the opportunities to deliver handsome returns for himself and his investors. At present, Vijay is developing five schemes in Edinburgh alone. He is unafraid to push the boundaries, exemplified by one of the current Edinburgh sites that has achieved planning consent for a mix of PBSA, assisted living and dementia care.

Vijay has a deep knowledge of Leicester having successfully completed five PBSA schemes there in recent years. His understanding of the micro-locations within the city and the opportunities they provide, combined with the in depth market research that is conducted for each scheme, ensures the viability of projects.

Vijay is relentless in his pursuit of developing schemes across the UK that offer the opportunities to deliver handsome returns for himself and his investors. At present, Vijay is developing five schemes in Edinburgh alone. He is unafraid to push the boundaries, exemplified by one of the current Edinburgh sites that has achieved planning consent for a mix of PBSA, assisted living and dementia care.

Vijay has a deep knowledge of Leicester having successfully completed five PBSA schemes there in recent years. His understanding of the micro-locations within the city and the opportunities they provide, combined with the in depth market research that is conducted for each scheme, ensures the viability of projects.

Architect: Oliver Lowrie

Director & Founder of Ackroyd & Lowrie

Ackroyd Lowrie is an innovative architectural practice committed to delivering high quality, bespoke spaces for our clients. Our studio is known for design excellence and focus on effective delivery for our clients.

The practice is led by Jon Ackroyd and Oliver Lowrie both of whom have extensive experience designing and delivering award winning schemes. Ackroyd Lowrie are currently working on a wide range of projects in the UK across the residential and commercial sector.Oliver is an architect and co-founder of Ackroyd Lowrie. Before founding Ackroyd Lowrie, he spent 10 years working at Architype. Most recently Oliver has spent three years as Project Architect for the prestigious £24m New Junior School for Highgate School in North London.

Planning Consultant: Danielle St Pierre

Director of Hybrid Planning & Development

We offer expert planning application, land, property and development advice throughout the UK.

Our focus is on providing added value to the planning and development process, whether you are a multi-national company seeking permission for a major development, or a private individual wanting to extend your home.

Our extensive experience allows us to advise in relation to the full remit of town and country planning matters and to deal with a range of projects from large scale development projects through medium sized development schemes, to smaller scale planning matters, undertaking research and preparing planning strategies.