OVERVIEW: Development Project

CurationTech Holding Ltd, are delighted to announce the launch of their latest project: Wates House, Fareham, near Portsmouth.

CurationTech is mainly focused on residential developments, but also targets new build houses/apartments and warehousing projects. Hand-in-hand with this is the achievement of planning permission to proceed with these developments.

Executive Summary

This latest project is the renovation of an existing Commercial Building into 26 apartments with planning permission already in place for the project.

Wates House, occupies a generous plot with excellent onsite car parking facilities. Internally, the building is configured with generous office accommodation over two floors, and includes toilet facilities, lift and stairwell meaning all necessary utilities are available on site.

Location

Fareham is situated on a picturesque coastline, providing a unique opportunity to explore a rich heritage of both maritime and national history, peaceful woodland walks, conservation areas plus an attractive safe coastline. With a history reaching far beyond Roman times to modern day heritage for the new millennium, from countryside to coast, Fareham has a variety of interests for everyone.

Wates House is located to the north of Fareham town centre and is within walking distance of pubs and restaurants in the historic High Street and indoor shopping precinct and Leisure Centre. Fareham offers excellent transport links to London (approx. 80 miles by road), is situated between the major cities of Portsmouth and Southampton, close to major road networks, and also has easy access to ferry ports of Southampton, Portsmouth and the Isle of Wight.

Project Details

The development consists of the conversion of an existing commercial to 26 no. apartments in a mix of Studio, Duplex, 1 and 2 bed layouts ranging from 398 sq ft to 775 sq ft. The work will take approximately 15 months, with planning permission already in place.

The Opportunity

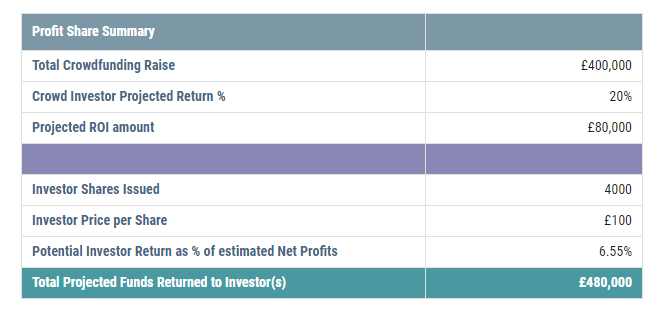

Investor(s) receive an estimated 20% ROI on £400,000 which equals £80,000, representing 6.55% on the projected profits, estimated to be £1,222,010 based on the value of the property once redeveloped.

Investment in property related assets puts your capital at risk and returns are not guaranteed. Please read the full risk warning on this site before deciding to invest.

Project Details

The development consists of the conversion of an existing commercial to 26 no. apartments in a mix of Studio, Duplex, 1 and 2 bed layouts ranging from 398 sq ft to 775 sq ft. The work will take approximately 15 months, with planning permission already in place.

The Opportunity

Investor(s) receive an estimated 20% ROI on £400,000 which equals £80,000, representing 6.55% on the projected profits, estimated to be £1,222,010 based on the value of the property once redeveloped.

Investment in property related assets puts your capital at risk and returns are not guaranteed. Please read the full risk warning on this site before deciding to invest.

FINANCIALS

Investor(s) receive a projected 20% ROI on £400,000 which equals £80,000, representing 6.55% on the projected profits, estimated to be £1,222,010 based on the value of the property once redeveloped.

The £400,000 equity raise will form a pot of funds to be used as working capital during the development of the site. The minimum raise has been set at £200,000 with the maximum raise at £400,000.

There are three potential exit options, which could be used in conjunction with each other potentially on an apartment by apartment basis:

Investment in property related assets puts your capital at risk and returns are not guaranteed. Please read the full risk warning on this site before deciding to invest.

HIETESH SHRIDHAR

Chief of Operations & Projects

Hietesh has 14 years of experience in engineering consulting, project & cost management, and on-site construction. He has worked with the Indian construction industry for most of his career and has commissioned multiple projects ranging from warehousing, industrial, commercial, hospitality, medi-care, residential, data centres, network operating centres and mixed land use projects.

Key Sector Expertise: Hietesh has acquired key experience in commissioning warehouses, warehouse automation, industrial, hotels, data centres, video walls and mixed land use projects.

RAJEEV K BANSAL

Chief of Finance and Acquisitions

Rajeev has 30 years of experience as a developer and in project management. He has worked with the Indian development and construction industry for most of his career and has commissioned multiple projects ranging from industrial, commercial, hospitality, medi-care, residential, data centres, network operating centres and mixed land use projects.

RAHUL DIXIT

Founder and Director - Asset Bricks

Rahul has over 17+ years of Real Estate experience in India and the UK property market.

Founder and Director of Asset Bricks, a Real Estate Development Firm, he has been involved in developing and delivering projects worth £30 Million across 15 different projects across UK.

With a wide functional operation and productive output, he has created a good eco-system for himself and his associates in and around the Real Estate markets in the UK. This has helped him in sourcing fine Real Estate development deals and also arranging the implementation of the projects mainly in affordable Residential and Mixed-used development.

Rahul has received MBA from Oxford Brookes University, with a specialism in Real Estate. Rahul is also the founder and director of Asset India, one of the first, and leading, property advisory companies for Indians living in the UK.

Founder and Director of Asset Bricks, a Real Estate Development Firm, he has been involved in developing and delivering projects worth £30 Million across 15 different projects across UK.

With a wide functional operation and productive output, he has created a good eco-system for himself and his associates in and around the Real Estate markets in the UK. This has helped him in sourcing fine Real Estate development deals and also arranging the implementation of the projects mainly in affordable Residential and Mixed-used development.

Rahul has received MBA from Oxford Brookes University, with a specialism in Real Estate. Rahul is also the founder and director of Asset India, one of the first, and leading, property advisory companies for Indians living in the UK.