OVERVIEW

Equity Raise: West Buildings

Executive Summary

TargetFive (T5) Group has been sourcing and developing properties since 2013. We pride ourselves on our agile and bespoke approach to helping our clients and directors find the right investments at the right time and achieving consistent returns. To date, we have completed more than 350 refurbishment and development projects across Sussex. We identify and develop pre-market and off-market opportunities, managing the complete process from purchase through to rental or sale.

The Strategy

TargetFive has a unique approach that allows investors to potentially achieve high yields but in central locations in thriving cities on the South Coast, rather than in less prosperous declining towns and cities further north. To achieve this T5 focus on their strict selection criteria/offer process to find properties that offer great value, versatility and potential for capital uplift. The key to this is large, flexible spaces and 35 West Buildings has that in spades.

Thanks to 35 West Buildings' large footprint, significant square footage and access from the front and rear, it is a very versatile project. As there is a shortage of good quality professional sharer accommodation in Worthing, we plan to turn the upper part of the building into a 2-bed flat and the lower part into an HMO-style 3 bed flat, all of which can be accomplished under Permitted Development. The ground floor commercial unit will be retained.

Project Details

35 West Buildings is a late Victorian mixed-use property in the centre of Worthing, adjacent to the seafront. Worthing Council has identified this parade as 'strategically important' to attract investment and potential grants. We immediately recognised the potential of the building when a trusted agent brought it to our attention. However, before making a decision we conducted the T5 Selection Criteria* to critically assess geography, cost/M2, yield, exit strategies, and primary and secondary rental markets. The building passed with flying colours and it has now been legally secured.

The Opportunity

We will purchase 35 West Buildings for £245k. This represents a £15k discount off the agreed purchase price, which was already £55k lower than the asking price. The conversion will take 14 weeks after purchase completion. At that point, the property will be let on an individual room basis to professional sharers. The rooms in the 3-bed flat will be let at £650 PP/PCM, the 2-bed flat will let for £1300 PCM, and the shop will let for £750 PCM. This will give a gross return of £48k per annum, or a 11.7% gross yield (MIRR 13.44%). The property will be purchased with Lloyds Bank development finance and then refinanced with them at project completion.

Download Offer Document for full details

* T5 Selection Criteria - see attached document

Financials

Project Financial Details

Purchase Price: £245,000

Acquisition Costs: £17,250

Renovation Costs: £145,000

Bank Funding: £263,900

Investor Funding: £142,538

TargetFive Funding: £812

TOTAL COST: £407,250

Expected Valuation after Renovation: £550,000

PROJECTED EQUITY VALUE CREATED: £142,750

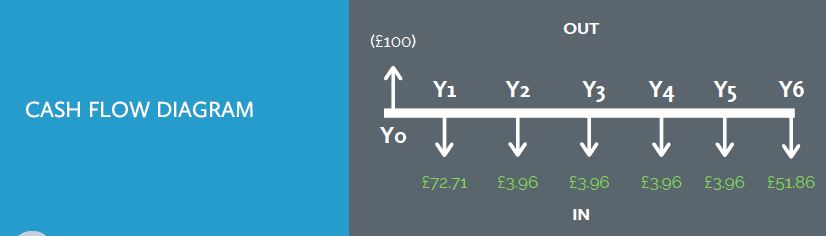

Investor Details

Target Raise Amount: £142,538

Phase 1 - Refinance (Between month 9 to 12): £101,758

Phase 2 – 50% Profit Share * (Between years 2 to 6): £5,522

Phase 3 – Buy Out (At the end of year 6): £68,280

Projected per annum MIRR for 6 year: 13.44%

*Profit Share is calculated as 50% net income after finance, management, bills, maintenance costs, corporation tax.

See Equity Offer document for more information.

Andy Babbayan

Director

Andy is an ex-Army Officer (Capt.) who specialised in bomb disposal and high-risk search. With an MSc in Risk Management, he takes a risk-focused and analytic approach to property. He is a professional landlord with a portfolio worth over £7M. Having overseen more than 350 property developments over 18 years, Andy’s current key focus, both with T5 and personally, is on high-yield investments and land development.

Tina Wenham

Director

Tina has over 20 years’ experience in property. She has worked on over 2000 transactions, including land sales with national PLC developers. As well as holding a Diploma in Residential Estate Agency, in 2018 Tina was elected President of the Brighton & Hove Estate Agents Association. To T5, Tina brings unrivalled market knowledge to the research, analysis and commercialisation of individual opportunities.

Tim Foden

Project Manager

Tim is a former estate agent turned project manager, contracting builder and carpenter with more than 70 property developments under his belt. From design inception to final snagging and certification, Tim takes a meticulous end-to-end approach to project management, and his trade and industry experience helps him co-ordinate stakeholders and reach the desired outcome.